UBS acquired Wealthfront for $1.4B in an all cash deal. Financial giant bought a tech product-centric firm, didn’t it? Yes, if you are in fintech, VC or generally in tech. Swiss bank bought a wealth management company with 27B AUM. This is how it sounds to folks in finance. You may think - what’s the difference? It’s an absolutely fair question. And I will give my answer in this post.

Robo Advisors: Growth

Robo advisors came to the market with a very bold statement - democratize access to professional investing. Product-led approach led to a few great products. These products simplified onboarding, deposits, decision making - generally what we know as wealth management. Companies have lowered entry barriers, Acorns and Stash Invest let users invest spare cash into the stock market.

We can argue when the robo advising craze started. Some classic wealth management firms can claim that automated investing started 20+ years ago. I want to focus your attention more on what we understand as robo advisors. Personal Capital, Betterment, SigFig and a few others were launched in 2007-2009. Wealthfront came to the market a bit later - in 2011. All of them have enjoyed the market.

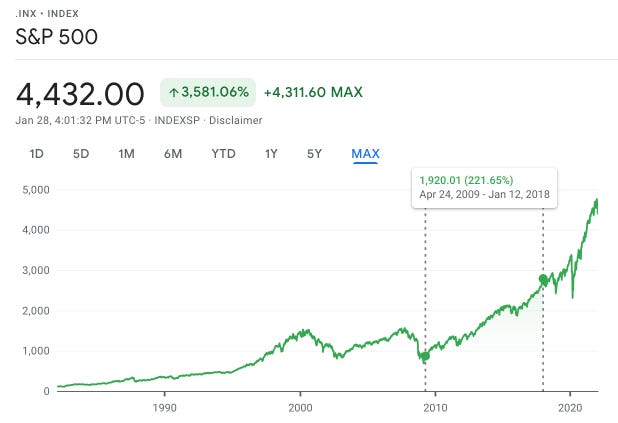

What happened with the market? S&P500 has gone up over 220% - from 800-ish in the beginning of 2009 to 2,800 area in the beginning of 2018.

Clients were happy. Robo advisors were riding that market wave. Investors were happy too. Product market fit was there too and cash was flowing into robo advisors from clients and investors. Next question - was there ever enough cash to sustain growth? Not for everyone.

Robo Advisors: Peak

In 2018-2019 the market has slowed down. S&P500 has gained “only” 17% over 2 years. Robo advisors started adding more products to their portfolio like cash and savings, expense management and more. To be fair, not only robo advisors. Marcus by Goldman Sachs has gained a lot of traction thanks to a simple and easy savings product and very high APY rates. Robinhood stepped into this territory too, although it took them a while to release the actual product.

This is where some very important “exits” happened. There were a few deals before 2018-2019 and one of the prime examples was the exit for FutureAdvisor. Blackrock paid $152M for the company backed by YC, Sequoia and a few others. FutureAdvisor had around 600M AUM, while Betterment and Wealthfront each had around 2.6B AUM. The company was making around $3M - it’s pricing was straightforward - 0.5% from AUM which was way higher than what competitors were charging. FutureAdvisor had around 320K users at the moment of acquisition [source].

So let’s remember this: $475 per user, 4x AUM / Acquisition Price, 51x Revenue.

One deal that rang the bell for me was the acquisition of WiseBanyan by Axos. WiseBanyan, according to Crunchbase, has raised 6.6M at the round before the acquisition, in April 2018. In October 2018 Axos announced that they acquired WiseBanyan for 3 million in cash. You can see the explanation of that deal in the Axos report here: https://static.seekingalpha.com/uploads/sa_presentations/845/34845/original.pdf

WiseBanyan reportedly had ~150M AUM and around 24K clients. It means that Axos has paid $125 for each user and certain product behind it. WiseBanyan’s business was very straightforward as well. They charged $1 per month per client. Easy math - they earned roughly around 290k a year.

There can be many reasons why such a deal went through with valuation assumed around $60-70M at the last round dropped to 3M. I will not go into speculations, since some of you may know more about this deal, product, leadership, agreements and the situation. I’ll just say - it rang the bell for me.

Numbers: $125 per user, 50x AUM / Acquisition Price, 10x Revenue.

What happened to others:

Wealthfront raised $75M round in 2018, 4 years after the previous $64M round;

Betterment raised $170M in 2016-2017 and then nothing until 2021;

SigFig raised $50M in 2018, 2 years after a $40M round;

Acorns received $105M investment in 2019;

Stash Invest raised slightly over $110M in 2018-2019 within 2 rounds;

The market has peaked. Rounds had become rare with significant time gaps. Acorns and Stash are the outliers. Both managed to raise funding when others have slowed down. Titan - another robo advisor which is actively managing your portfolio instead of investing in ETFs - came to the market in 2018. They raised their next round 2.5 years later in 2021 with 11M of fresh funding.

The most important question - why did the market peak? I highlight a couple reasons.

Old wealth management firms have become significantly better. Robo advisors solved the problem of onboarding, Vanguard and others caught up. Betterment, Wealthfront and others simplified portfolio tracking and auto investing into ETFs, again big funds have improved their digital presence too. Pricing? Vanguard is a fund that has built its own ETFs products. Price competition has become tough.

Access to markets was democratized by other players. We may even call it a horizontal expansion. Robinhood, Webull, Public.com and more companies have simplified access to the markets in general. Now when you have 401(k) with large funds and managers, you can invest spare money into stocks. It is more fun for small amounts than looking into slowly growing ETFs.

Robo advisors have grown to hundreds of thousands of clients. Old established firms moved into digital space. New players have changed the investment market in general. Who would this market evolve now?

Robo Advisors: Maturity

When the market peaks, consolidation takes place. Consolidation may occur in 2 different ways. One - robo advisors will start offering other financial products and go into credit cards, loans, banking and more. Two - large wealth management companies will extend the AUM portfolio with new funds and new types of clients.

This is exactly what happened. All robo advisors started offering new products. Most popular ones - credit cards. Very crowded space, lots of companies moved into it. Savings accounts - gained popularity before pandemic in the era of high rates. Robo advisors wanted to find new ways of making money out of their fastly grown audience.

First big deal in that market happened with Personal Capital. In August 2020, Empower announced that it’s acquiring Personal Capital for $1B.

This section contains a ton of boring numbers, you may skip this part to the summary.

At the time of acquisition Personal Capital had 13B AUM from around 22.7k clients. Personal Capital’s business model is focused on converting free users with basic functionality into the paid model of financial advisory firms. When acquired, they had around 2 million accounts in total. Revenu was assumed to be in the range of $75-100M. You can check current Personal Capital’s numbers in their ADV form.

The deal’s worth 1B, leaves us with such summary:

$44,129k per client, $500 per user

AUM / Acquisition Price: 13x

12x Revenue

On the other side - wealth management firms. 2021 was on pace to become the record year for M&A deals in wealth management [source]. This is where I want to stop your attention. Quick summary of what happened:

Source: Fidelity M&A in Wealth Management

33 deals happened in December only. Although there were only a few deals that were of a similar size to the UBS-Wealthfront deal.

Although most of the deal amounts are not disclosed by the parties, one deal caught my attention. SVB acquired Boston Private Bank in January 2021:

900M deal

Boston Private: $17.7B AUM, $367.5M Revenue

AUM / Acquisition Price: 20x

2.45x Revenue

Let’s compare this to what we have in our UBS-Wealthfront deal. As for October 2021, based on ADV-2 form, Wealthfront numbers look like this:

Clients: 327,356 (individuals + high net worth)

AUM (of individuals + high net worth): $24,796M

Revenue (estimated by their fees): $62M

The UBS-Wealthfront deal was worth $1.4B. It leaves us with:

$4,277 per client

AUM / Acquisition Price: 17.8x

22x Revenue

Summary

The key takeaway - Wealthfront was fairly valued by the AUM. We can see similar numbers in the deal of SVB and Boston Private. UBS clearly assumes that they can make more money out of Wealthfront's clientele. The target revenue for that much of AUM and accounts can go as high as $200-400M. Only time will tell how fair that assumption is.

Wealthfront was valued slightly worse than Personal Capital AUM-wise, but way better from average client price perspective. Whether the freemium model works better - hard debate cause we don’t know the real ROI. The fact is - Wealthfront was able to get a better price client-wise without giving any of their features or products for free.

I think it’s the best deal Wealthfront could get out of the current situation. I also assume that it’s a perfect deal for UBS as well. If they are able to turn this business into a cash machine, the return on investment will be astonishing.

Peace ✌️